Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

AUDCHF - D1 Timeframe

AUDCHF as seen in the daily timeframe chart above, has just bounced off the pivot zone, with a likely retest having been completed as well. Considering the bearish array of the moving averages and the supply zone within the pivot region, I am inclined to tilt my sentiment in favour of the bears in this case.

Analyst’s Expectations:

Direction: Bearish

Target: 0.57683

Invalidation: 0.59481

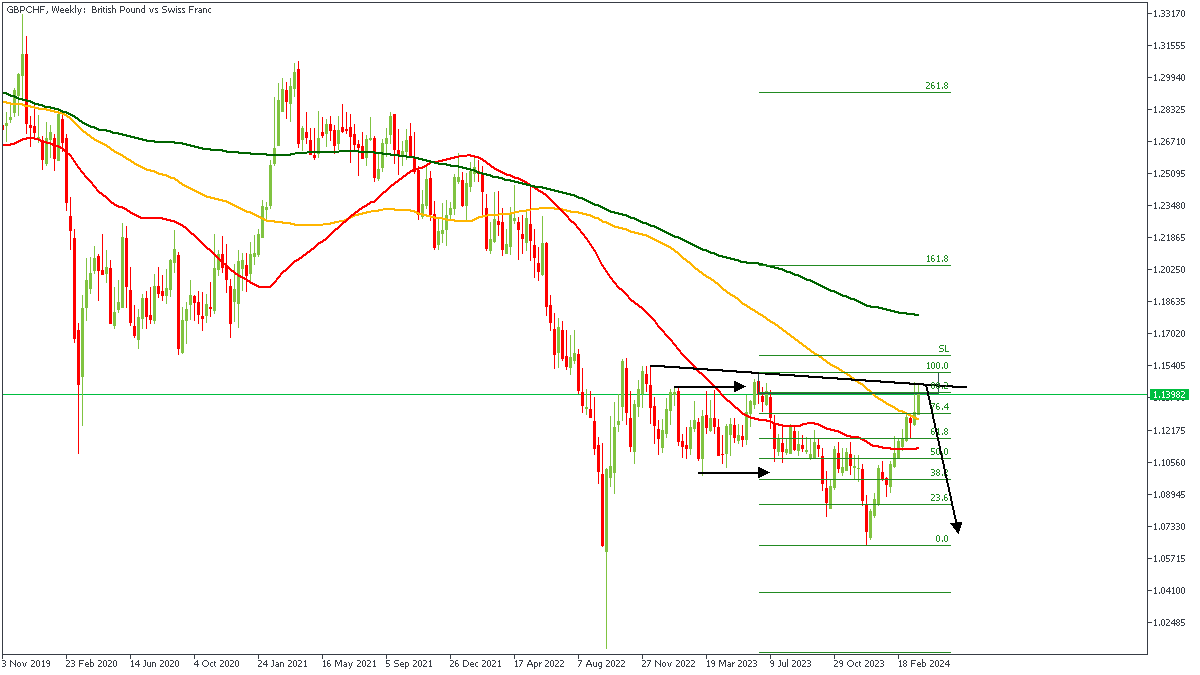

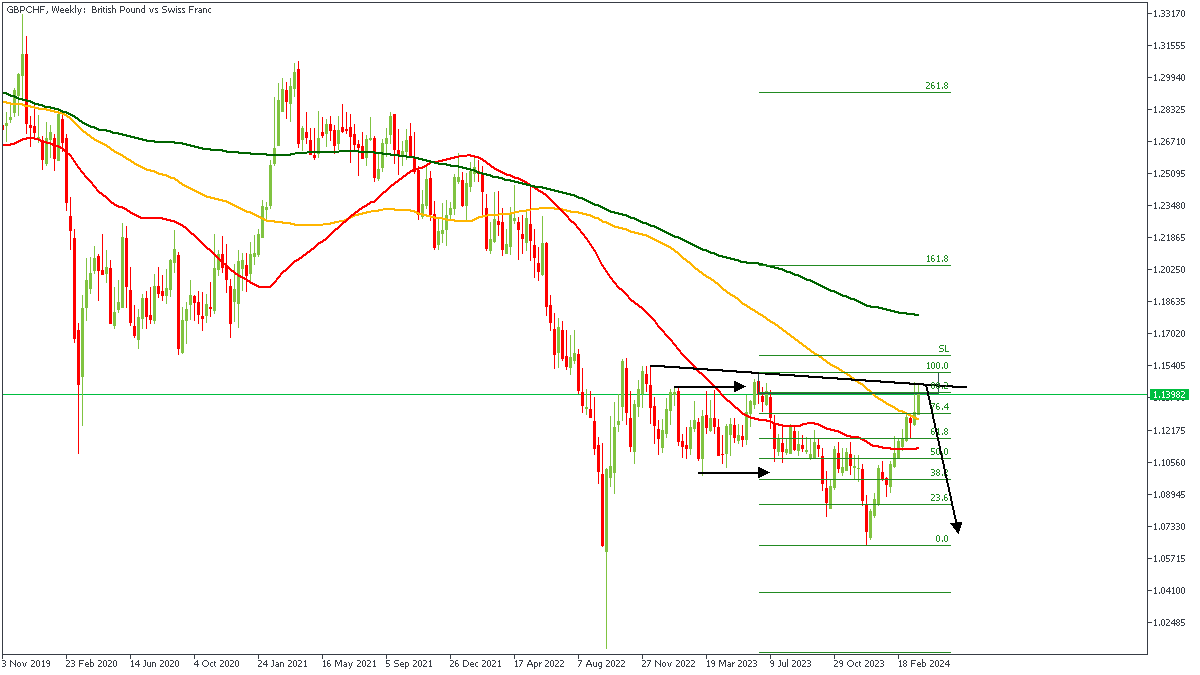

GBPCHF - W1 Timeframe

GBPCHF on the weekly timeframe seems to have printed a solid QMR pattern. We’ve seen an area of accumulation (bounded by the two horizontal arrows), as well as the distribution and now I believe the correction of the distribution is at its end. The confluences for this trade are; the bearish array of the moving averages, the 88% of the Fibonacci retracement level, trendline resistance, the QMR pattern, as well as the rally-base-drop supply zone.

Analyst’s Expectations:

Direction: Bearish

Target: 1.09891

Invalidation: 1.15292

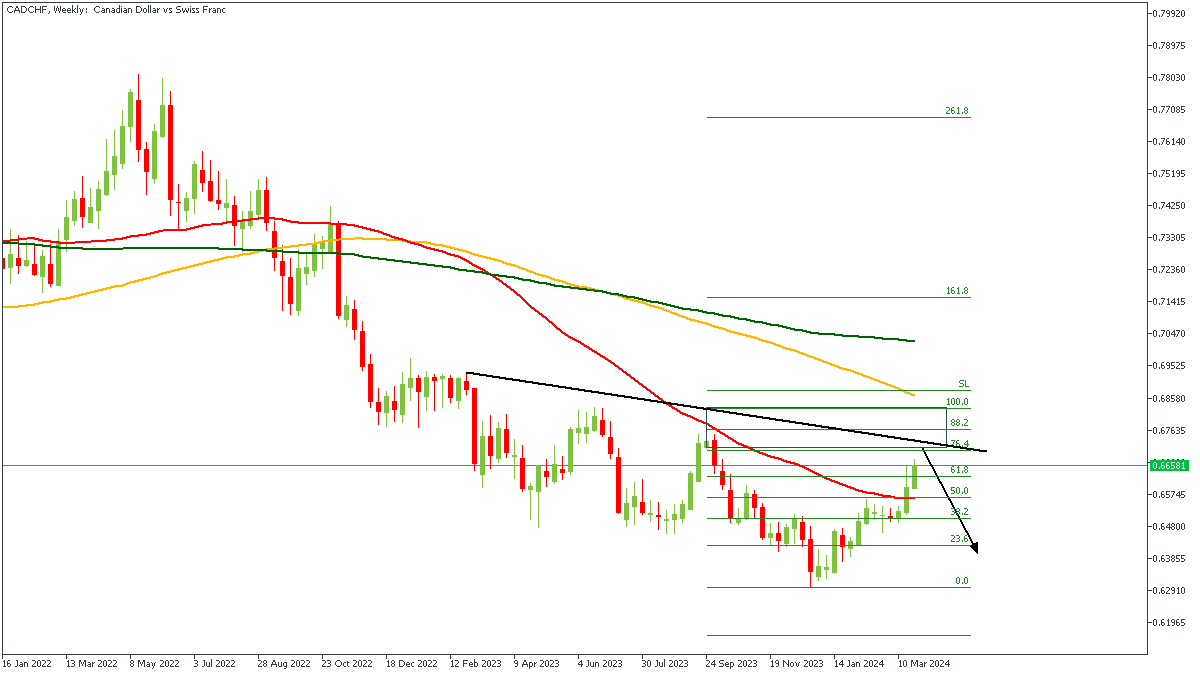

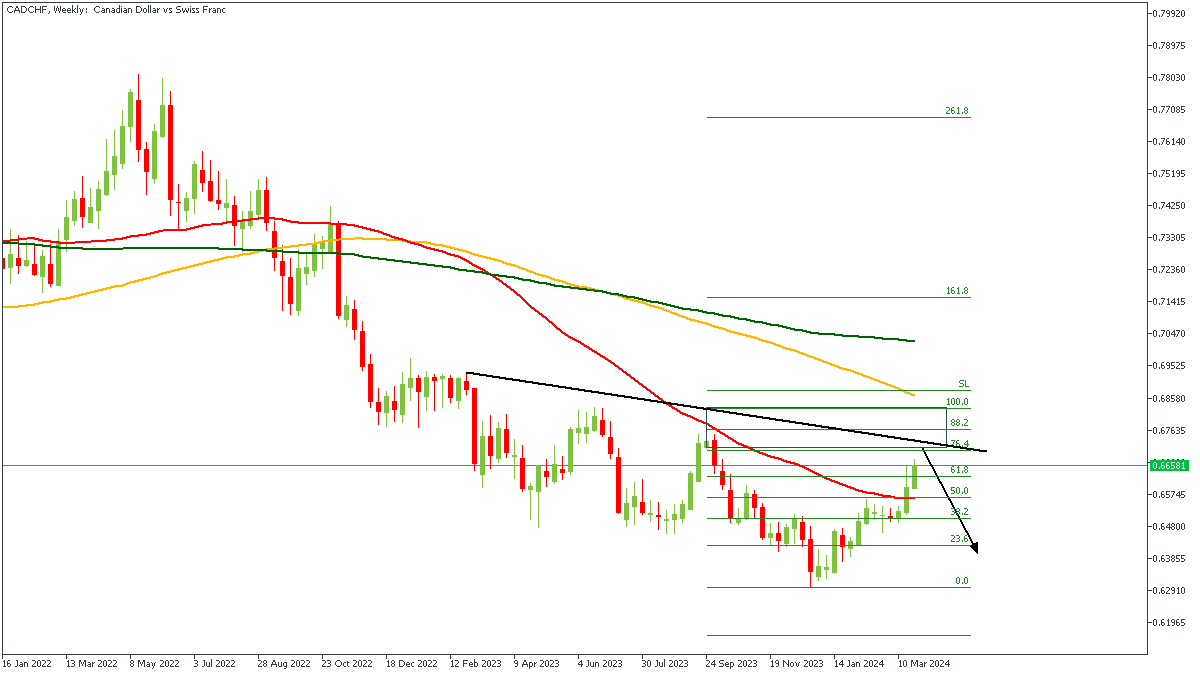

CADCHF - W1 Timeframe

The prevalent trend on CADCHF is quite clearly bearish. We can as well see the confluence of the trendline resistance and the rally-base-drop supply zone. The Fibonacci retracement level and the bearish array of the moving averages provide additional confirmation of a bearish sentiment.

Analyst’s Expectations:

Direction: Bearish

Target: 0.65454

Invalidation: 0.68378

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

TRY TRADING NOW

You can access more of such trade ideas and prompt market updates on the telegram channel.