USDCHF saw a rebound after declining for two days straight, climbing towards the important psychological level of 0.8800 during Wednesday's early Asian trading session. There's some pressure on the Swiss Franc (CHF) as traders await the Swiss ZEW Survey – Expectations report scheduled for later today. Moreover, investors are keeping an eye on Thursday's release of the Gross Domestic Product (GDP) data by the Swiss State Secretariat for Economic Affairs (SECO), with expectations for a decline in the fourth quarter of 2023.

EURCHF - D1 Timeframe

EURCHF on the daily timeframe can be seen reacting under pressure from the trendline and moving average resistance. The bearish array of the moving averages lends another credible confluence in favour of a bearish sentiment on EURCHF, leading me to expect a drop with the 50-day moving average as my target

Analyst’s Expectations:

Direction: Bearish

Target: 0.94451

Invalidation: 0.95628

GBPCHF - D1 Timeframe

GBPCHF on the daily timeframe has created a double-top pattern right inside the daily supply zone; a resistance trendline adding to the likely reasons for the rejection. Based on the bearish positioning of the moving averages, I expect to see a bearish price action going forward till the 1.12150 target area is reached.

Analyst’s Expectations:

Direction: Bearish

Target: 1.09934

Invalidation: 1.12119

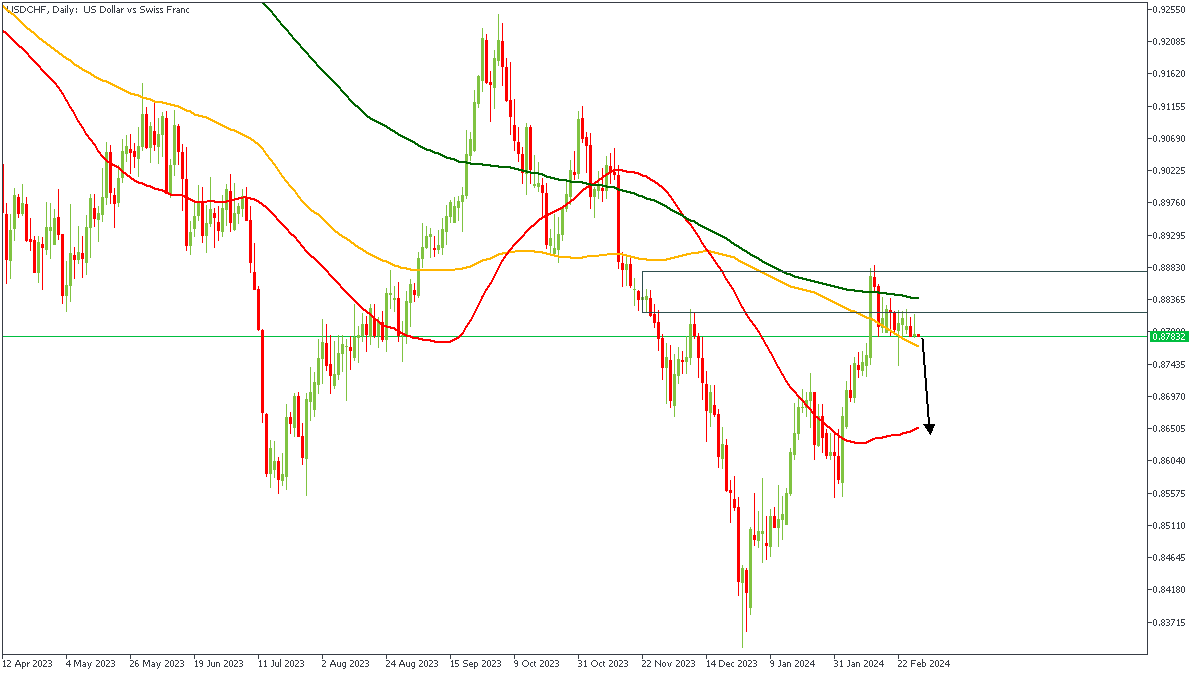

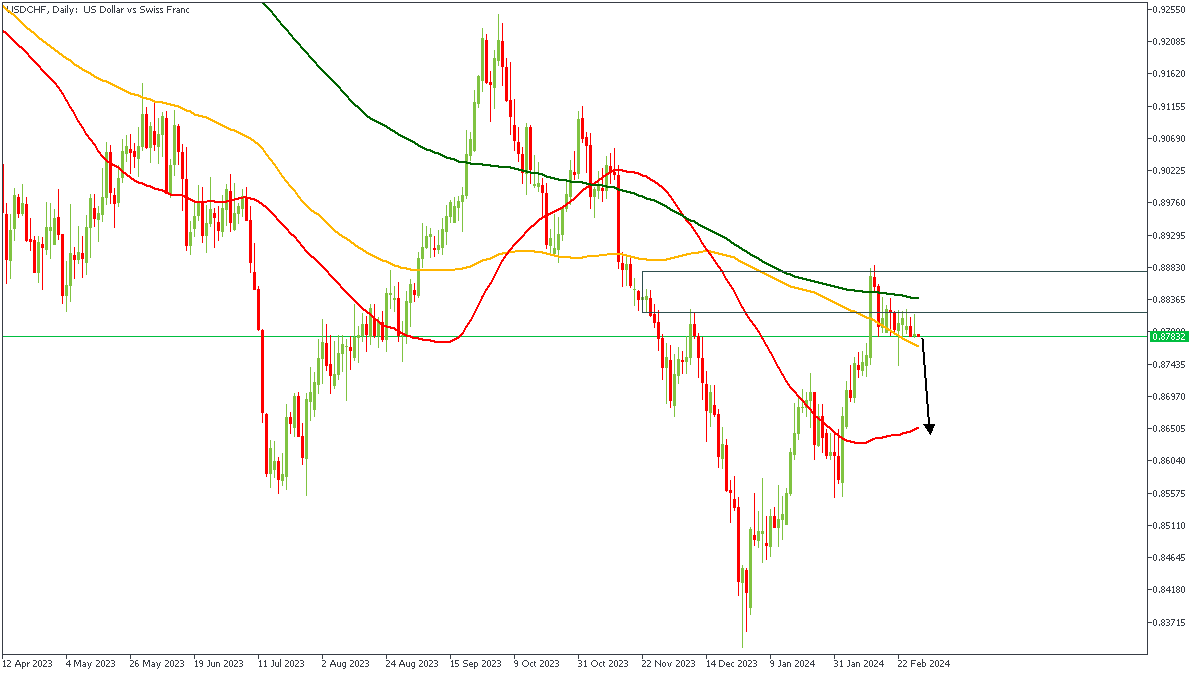

USDCHF - D1 Timeframe

Dropping from a confluence of the 200-day moving average, and the supply zone, USDCHF seems to be having a hard time climbing beyond the supply zone. In light of this, and considering the bearish array of the moving averages as a confluence, I will sustain a bearish sentiment in the meantime.

Analyst’s Expectations:

Direction: Bearish

Target: 0.87072

Invalidation: 0.88341

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

TRY TRADING NOW

You can access more of such trade ideas and prompt market updates on the telegram channel.