Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2024-02-29 • Updated

After creating record highs, Wall Street's main indexes opened on Wednesday and began to edge lower, reflecting cautious sentiment among investors. They're eagerly awaiting crucial inflation data that could impact the U.S. Federal Reserve's interest rate decisions. The upcoming release of the personal consumption expenditures (PCE) price index is expected to show a rise in prices for January. Despite recent excitement over strong earnings and advancements in artificial intelligence, the stock market has faced challenges in the past few days. Persistent inflation concerns, along with evidence of a strong U.S. economy, have led traders to adjust their expectations. Many now anticipate the first rate cut to occur in June, reflecting uncertainty about inflation and the Fed's response.

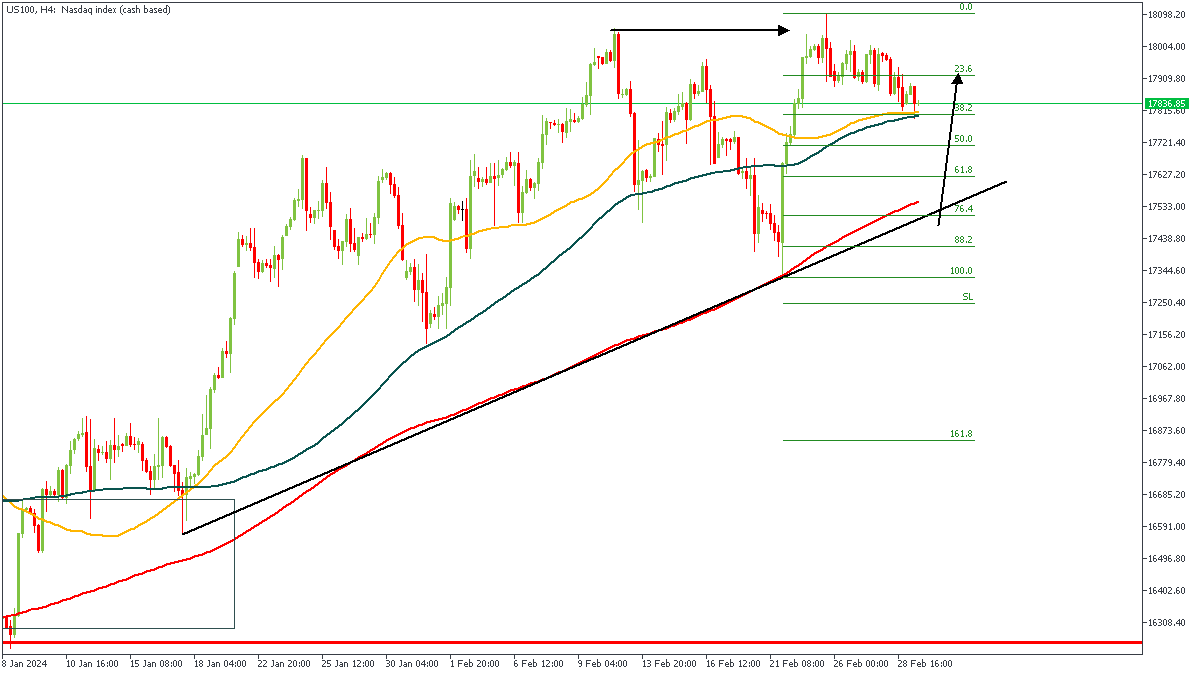

US100 recently created a record high around the 18,100 price mark, after which we saw a sluggish decline; which seems to still be in place at this time. However, considering the recent break above the previous high, and the bullish array of the moving averages, it is quite clear that the market sentiment still remains bullish. So, combining this sentiment with confluences from the trendline support, demand zone, and Fibonacci levels, I am convinced that price may resume its bullish outlook soon.

Analyst’s Expectations:

Direction: Bullish

Target: 17,915.54

Invalidation: 17,310.77

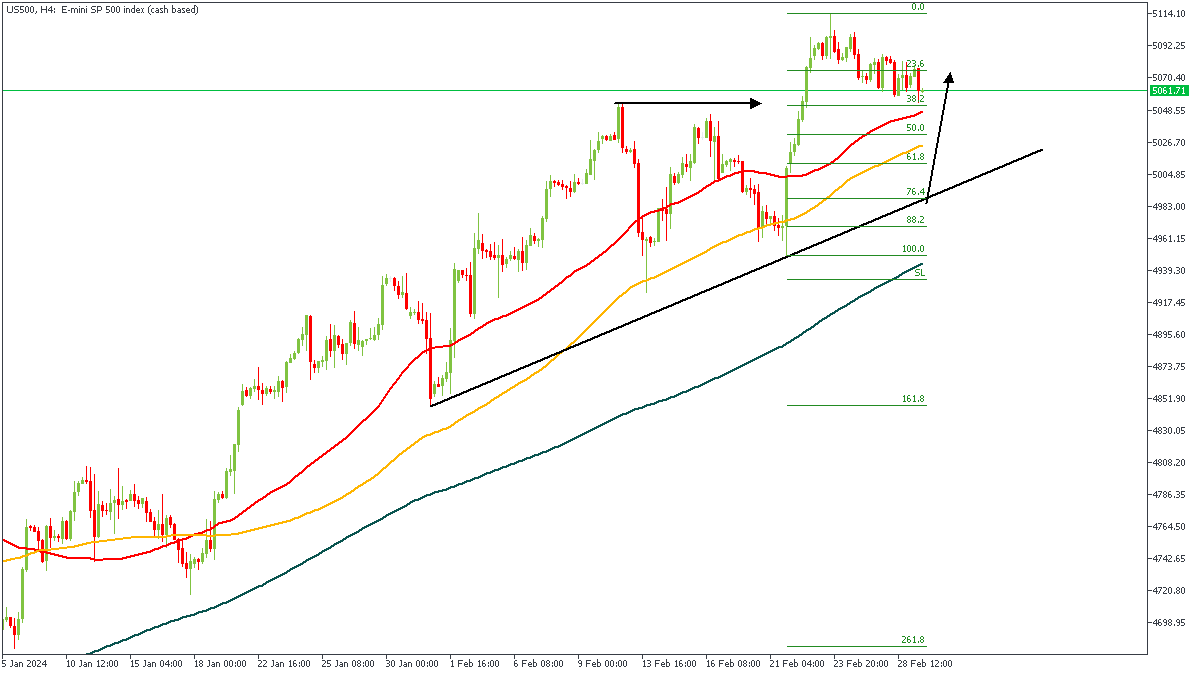

In the same vein as we saw on the US100 chart, US500 recently created its own record high at the 5114.38 price area, following which we saw price slip lower towards the demand zone that caused the break of structure. The bullish array of the moving averages, the trendline support, drop-base-rally demand, and the Fibonacci levels lend credence to my expectation of a bullish outcome in the nearest future.

Analyst’s Expectations:

Direction: Bullish

Target: 5074.68

Invalidation: 4946.10

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Coinbase (#COIN) saw its revenue rise to $773 million in Q1 2024, marking a 23% increase from the previous quarter and surpassing analyst expectations.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!