Major currency pairs like USD/JPY and USD/CHF face potential shifts in trends as central banks reevaluate interest rates. The Euro and British Pound are poised for nuanced movements based on economic conditions and rate decisions. Meanwhile, the Australian and New Zealand Dollars grapple with changing interest rate differentials and economic uncertainties. For now though, let’s look at a few trading opportunities for the month of February.

AUDUSD - D1 Timeframe

AUDUSD seems to be under a lot of bullish pressure from the trendline support and the 100-day moving average, both of which seem to be preventing prices from going any lower than they already are. This means we could get to see price scale up slightly to shake off some of the pressure, before sliding much lower to break the trendline and reach the 200-day moving average target below.

Analyst’s Expectations:

Direction: Bearish

Target: 0.65159

Invalidation: 0.67356

GBPJPY - D1 Timeframe

GBPJPY has been sulking around the weekly supply zone, with a very sluggish price action that indicates slowing momentum from the buyers. This simply means that with the advent of new selling pressure, we can expect to see GBPJPY slide much lower towards the 200-day moving average as a target.

Analyst’s Expectations:

Direction: Bearish

Target: 184.047

Invalidation: 188.700

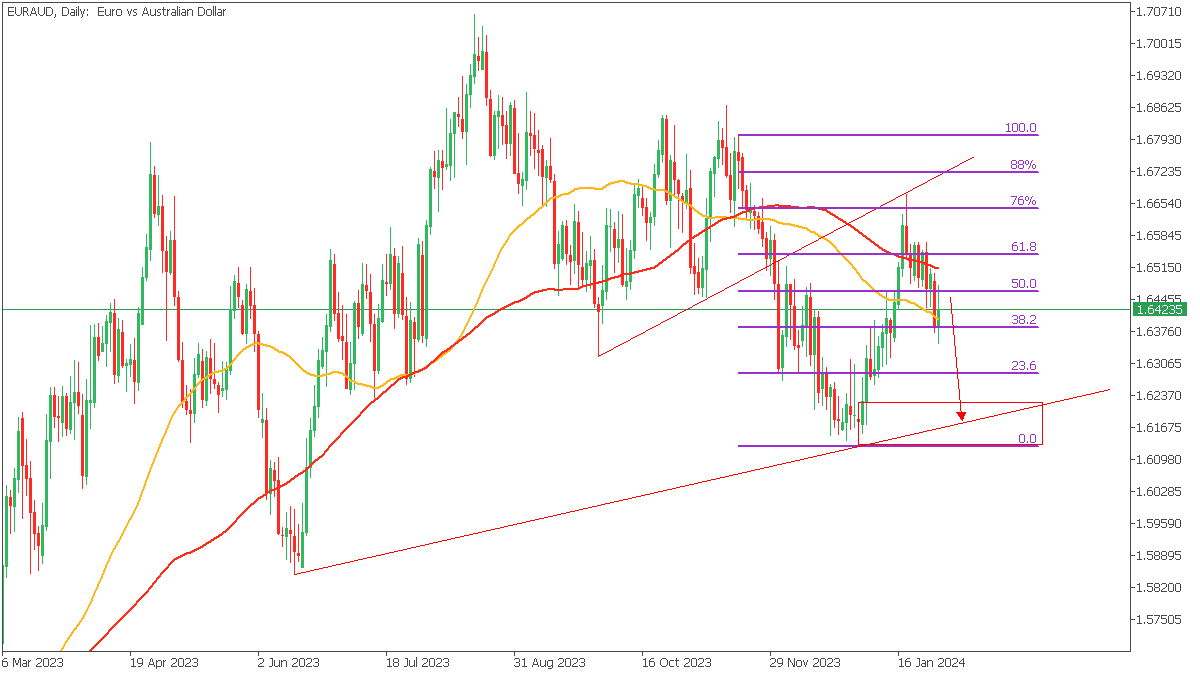

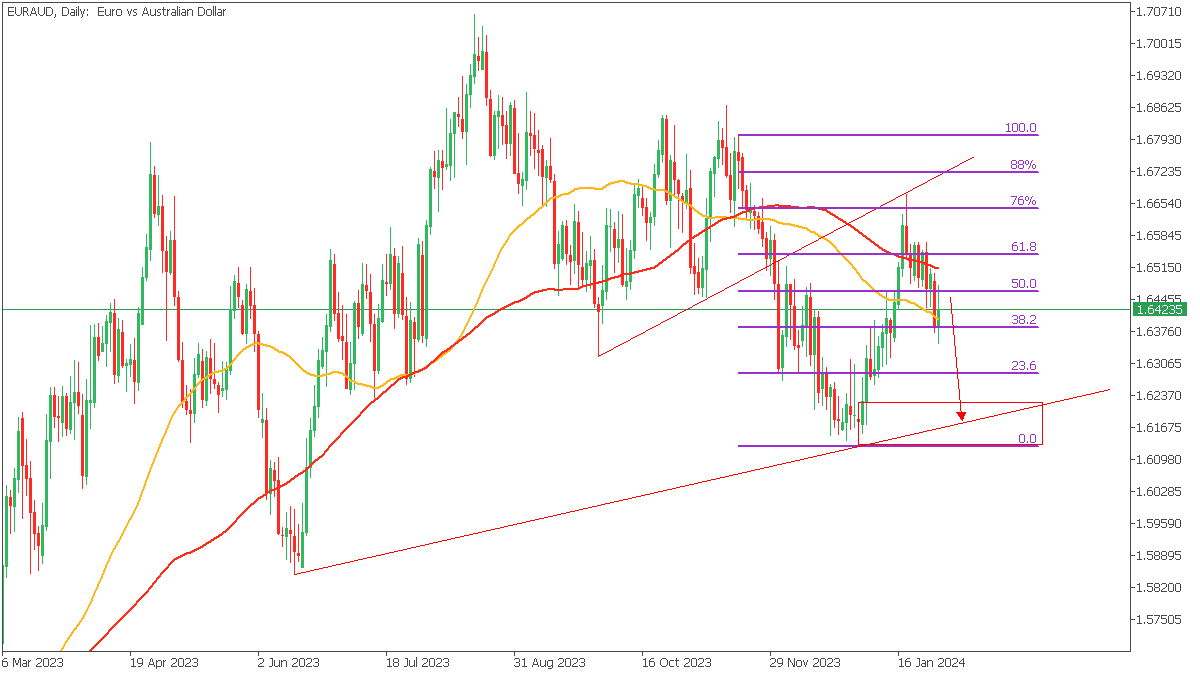

EURAUD - D1 Timeframe

EURAUD as seen on the chart recently got rejected from the intersection of the trendline resistance, and the 76% Fibonacci retracement level. The bearish array of the 100 and 50-day moving averages is another confluence in favour of the bearish sentiment. In this case, though, my target is not a moving average, rather, it is the demand zone that is seen overlapping the trendline support in the attached chart image.

Analyst’s Expectations:

Direction: Bearish

Target: 1.62309

Invalidation: 1.65113

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

TRY TRADING NOW

You can access more of such trade ideas and prompt market updates on the telegram channel.